One article to understand the Cutting-Edge “ Fintech”

"Fintech" is a highly "controversial" term that combines internet and financial elements. Recently, due to a job transition, I've had the opportunity to settle down, read some books, and systematically study and organize my understanding of Fintech. On one hand, this is due to my love for this profession over the years; on the other hand, I believe that if mobile internet and mobile banking are the first half of fintech, and big data and cloud computing technologies are the mid-game, then blockchain, privacy computing, and artificial intelligence will decide the winners and losers in the second half of the game.

To understand "Fintech", we can use the "4W1H" framework to understand the basics of fintech:

What - What is fintech? What are the main technologies of fintech? What key problems need to be solved?

Why - Why did fintech appear? vs What problems did traditional finance encounter? What is internet finance?

When - When did it start to develop?

Who - Which companies are representative of fintech?

How - How is fintech regulated?

What is Fintech

Finance and technology were originally two separate fields, but we should never underestimate how a seemingly unrelated industry might disrupt your own. Do you know how the camera died? Sony, Canon, and Samsung didn't kill it, smartphones did. Many industries can't survive, not because they're killed by competitors in the same industry, but because they're disrupted by other industries. It's the same with banks, which have been in a state of panic for a long time, but it's not due to competition from their peers.

Fintech (Financial Technology) refers to traditional financial enterprises using technological means to promote innovative changes, improve efficiency, and enhance user experience, or new start-ups using technological means to launch new financial products or business models.

Or, to put it another way, when traditional financial institutions encounter rapidly developing internet technology, everything changes. This technology is fintech. It's not here to destroy tradition, but to make financial services better, faster, and smarter to meet people's demands for inclusivity and efficiency. So, because of fintech, you no longer need to queue at the counter to do business like you used to, you no longer need to carry change to buy roasted chestnuts, you no longer need to worry about low interest rates for your money in the bank, and you no longer need to worry about lack of funds for renovations...

Why did Fintech appear

When something is innovated, it's because the old thing encountered problems or bottlenecks. These bottlenecks either have regulatory defects or can't meet people's ever-changing needs. Fintech is the same, it appeared because the products and models of traditional finance can no longer meet the rapidly developing social needs.

1) Traditional finance encountered difficulties

Although traditional financial institutions have a complete range of products, a mature system, perfect regulatory policies, and licensing advantages, they lack the ability to respond to market competition, their business models are rigid, leading to low innovation ability, and it's difficult for financial products to differentiate. The future competition will be about service quality and cost reduction and efficiency improvement.

2) Internet finance

The development process from traditional finance to fintech has experienced a controversial process, which is often referred to as "Internet finance".

The rise in 2013, the emergence of internet model finance (P2P online lending, internet payment, crowdfunding, finance), the lack of regulation of barbaric growth, the biggest problem of internet finance is that it is talking about a "substitute finance" ability, do you think it's appropriate? However, it can't be denied that internet finance has awakened tradition. Wu Xiaobo said in "Stirring Thirty Years" that reforms always start with violations. It seems to make sense.

Then, during the strong years of internet finance, the regulation carried out the most severe rectification of P2P in history. We can see many tech companies starting to definance, in a sense, it is the "tech" to "finance" role correction, to put it simply, tech can't replace finance, tech can only empower finance. During this period, a series of "finance" became "NumSci".

3) The advantages of Fintech

Fintech has a strong differentiated competitive advantage over traditional finance, for example:

Traditional finance, the main ability is to "identify good people", serve high-quality customer groups, if there is a problem, "stop business", they often mention the keywords of mortgage, guarantee;

And fintech, the greater ability is to "identify bad people", serve all customer groups, if there is a problem, optimize through model adjustment, "business continuous", we often mention the flow, model, etc.

So essentially, you will find that the introduction of fintech, for the public, has become convenient, efficient, inclusive; for financial institutions, they start to focus on KYC (Know Your Customer), focus on service quality and cost reduction and efficiency improvement. In comparison, fintech compared to traditional finance: low cost, high efficiency, wide coverage, fast development.

The empowerment of fintech to traditional finance and dimension reduction attack mainly includes 2 levels, the first stage is the evolution of infrastructure and core system upgrade with IT as the core (mobile internet, mobile banking, etc.), the second stage is the evolution and upgrade of financial business with Data and AI as the core (cloud computing, big data, blockchain, privacy computing, artificial intelligence, etc.), this time, I will continue to write some about the latter stage of technology and application.

The development history of Fintech

Promoting the development of fintech, I think there are mainly 3 factors: the development of internet technology, the constraints and improvement of financial regulatory policies, and the competition and innovation faced by traditional financial institutions themselves:

Technology is definitely the driving force for industry reform. In fintech, we can feel the biggest impact is mobile payment, such as Alipay's emergence changed people's habit of carrying money out, just as live broadcast changed people's shopping habits, and the change in habit brought about by this technology is often irreversible. Just like Kodak's overnight bankruptcy was due to being dimensionally attacked by digital cameras, because the world no longer needed it.

Looking at the whole development process of fintech, it's generally divided into 3 stages: traditional fintech, social fintech, intelligent fintech. (This segmentation is taken from "Weiyang Network")

1) Fintech 1.0

"Infrastructure technology", also known as Classical FinTech, i.e., traditional financial technology. Before 2013, it can be called the 1.0 era, because before 2013, although finance was closely integrated with technology, it did not reach the current widespread application.

- Characteristics: Traditional financial institutions use IT technology, top-down promotion, data closure as the main.

- Representative industries: Including software service providers, hardware service providers, SMS, outbound calls, traditional data (payroll, bank flow, credit) and so on.

2) Fintech 2.0

"Technology + Finance's blooming and trial and error", also known as Social FinTech, i.e., socialized financial technology. Around 2013, the representative business forms of the simultaneous explosion of civil finance include P2P, online lending, finance, crowdfunding, third-party payment, consumer finance, etc.

- Characteristics: Internet financial institutions lead the technology trend, traditional financial institutions selectively follow, bottom-up promotion (many internet financial institutions are very flat in management).

- Representative industries: Including risk control modeling, third-party payment, big data risk control (blacklist, device anti-fraud, live body recognition, location information), online arbitration, electronic signature, integrated customer service system, cloud computing, network security, etc.

3) Fintech 3.0

"Eliminating the false and preserving the true, regulation, and healthy development", also known as Intelligent FinTech, i.e., intelligent financial technology. Specifically, in terms of finance, with the reform of the national financial system and the increasingly perfect financial regulation, the operation of the financial industry will be mainly licensed. In terms of technology, 5G, IoT, AI, blockchain and so on will also erupt after the infrastructure is improved.

- Characteristics: Operational intelligence (finance as a fully digitized industry, many links can use technology to replace), regulatory intelligence (China's current regulatory situation is mixed business and separate regulation, separate regulation has historical reasons and IT means insufficient, mixed business regulation cost high, with the intervention of the Internet of Things artificial intelligence, regulation will also usher in a new stage), a large number of traditional financial enterprises that can't use new technology are hard to survive.

4) What is the core of Fintech

"Fintech second half" - Financial data sharing.

Western finance called 2018 Open Banking - open bank service year. Jack Ma said, "Humanity is moving from the IT (Information Technology) era to the DT (Data Technology) era."

In the DT era, data becomes the most valuable asset. For example, you have deposits in Industrial and Commercial Bank, you take out a loan to buy a house in Ping An Bank, you trade stocks in CITIC Securities, and you also have a credit card from China Merchants Bank

What's Your Reaction?

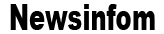

:quality(85):upscale()/2024/01/25/878/n/1922153/f94f61ec65b2bf18018990.47538761_.jpg)

:quality(85):upscale()/2024/01/26/751/n/1922153/6bd241b765b3e57a0c5559.91495665_.png)

:quality(85):upscale()/2024/01/26/759/n/29590734/b7f6660b65b3e8460d7196.77057039_.jpg)